Blog

Rethinking Your Lease? Dubai Rental Price Forecasts & Best Communities for Q1 2026

The Dubai property market never sleeps. For tenants, this rapid pace means that planning your lease renewal or next move in the Emirate requires foresight, especially as we approach the critical planning window for Q1 2026. Will the soaring rents of the past two years continue, or is the market finally showing signs of moderation?

This expert guide will provide you with a definitive outlook, pinpointing the best areas to rent in Dubai for every budget and lifestyle, and giving you the tools to approach your landlord with confidence and market knowledge.

Context: The Market Drivers Leading to Q1 2026

The strong rental increases observed throughout 2024 and much of 2025 were driven primarily by global investor and expatriate inflows, fueled by the UAE’s robust economy and flexible visa reforms (such as the Golden Visa). Demand simply outstripped supply.

However, the market is poised for a significant shift as we approach Q1 2026. Analysts suggest that two key drivers are now counter-balancing the ongoing demand:

-

New Supply Pipeline: The market is preparing for a wave of new unit handovers, estimated to be over 70,000 units across 2025 and 2026. This surge in availability, particularly in the apartment segment, increases tenant choice.

-

Affordability Migration: Continuous high rents in prime districts have pushed price-sensitive tenants toward mid-market and suburban corridors, intensifying competition and driving up quality expectations in those areas.

These factors indicate that while a market “crash” is highly unlikely given the continued population boom, the era of double-digit annual rent hikes is drawing to a close.

Q1 2026 Rental Price Forecast

The outlook for the Dubai rental price forecast 2026 is defined by segmentation. Tenants must understand the micro-market trends relevant to their location:

| Market Segment | Key Areas | Projected Q1 2026 Trend | Forecasted Growth Range |

| Prime / Luxury | Dubai Marina, Downtown Dubai, Palm Jumeirah | Stabilization & Resilience | Low single-digit growth (0%–3%) |

| Mid-Market / Affordable | JVC, Dubai Sports City, Arjan, Dubai South | Moderation due to Supply | Moderate growth (4%–7%) or localized stabilization |

| Family / Suburban | Dubai Hills Estate, Arabian Ranches | Sustained Strong Demand | Consistent growth (5%–8%) |

The Forecast in Detail:

Prime areas, such as the Marina and Palm Jumeirah, will remain resilient due to highly limited supply and sustained demand from HNWIs, but prices are nearing their peak, leading to stabilization (0%–3% growth).

In contrast, mid-market communities like JVC and Dubai South, which have seen heavy construction, will bear the brunt of the new supply. While high demand from the growing population will prevent a steep decline, Dorz data indicates the growth rate here will moderate significantly. Landlords of older or poorly maintained properties may be forced to offer incentives or accept stabilization to secure tenants.

Crucial Timing Tip:

If you are planning a move or renewal in Q1 2026, be proactive. The period immediately following the busy holiday season (mid-January to late February) often sees a surge in new listings as tenants move out. Starting your search early, ideally in late 2025, will give you access to the best units before the general Q1 rush.

Spotlight: Best Communities for Renters in Q1 2026

Securing the best value means looking beyond the familiar names. Here are the best areas to rent in Dubai for distinct renter profiles heading into the next year:

1. The Value Seeker: Jumeirah Village Circle (JVC) / Dubai Sports City

-

Target Audience: Young professionals, budget-conscious couples, and small families.

-

Q1 2026 Trend: Stabilization and high choice. JVC is the quintessential mid-market outperformer, and with new supply delivering, renters here have more bargaining power than in almost any other established community.

-

Why it’s the Best: These areas offer value-for-money without sacrificing key amenities like gyms, pools, and community parks. Their central location, while slightly less connected by Metro, makes commuting manageable via road networks. You are likely to find an affordable apartments Dubai 2026 here with excellent amenities.

2. The Corporate Professional: Business Bay / Downtown Dubai

-

Target Audience: Corporate executives, financial professionals, and high-income earners prioritizing location and convenience.

-

Q1 2026 Trend: Stable prices with low vacancy. While high, rents here are not expected to skyrocket further. They are underpinned by corporate demand and the unparalleled proximity to DIFC and major business hubs.

-

Why it’s the Best: Living here offers unmatched liquidity and connectivity. Properties are generally modern, and the lifestyle is geared towards urban efficiency. If your lease renewal advice Dubai 2026 is driven by commute time, these areas remain unbeatable, despite the premium.

3. The Family Planner: Dubai Hills Estate / Arabian Ranches

-

Target Audience: Families with school-age children, or anyone seeking villa/townhouse living and dedicated green space.

-

Q1 2026 Trend: Sustained growth, but worth the premium. Villas and townhouses in master-planned communities remain highly competitive due to limited supply and continued preference for space.

-

Why it’s the Best: These communities offer the long-term lifestyle that expatriate families desire—integrated schools, retail centers, parks, and world-class sports facilities. While more expensive, the stability of the community and the quality of life often justifies the higher rental cost. These are the best communities for families in Dubai Q1 2026.

V. Actionable Advice for Tenants & Renewal Tips

Navigating a lease renewal or a new agreement requires timely action. Use these strategies to secure your best rental outcome for 2026:

-

The RERA 90-Day Rule: The most critical regulation. For a landlord to legally change your rent or evict you (for specified reasons), they must provide a legal notice via notary public or registered mail 90 days prior to your lease expiry date. If you receive late notice, you can challenge the proposed increase.

-

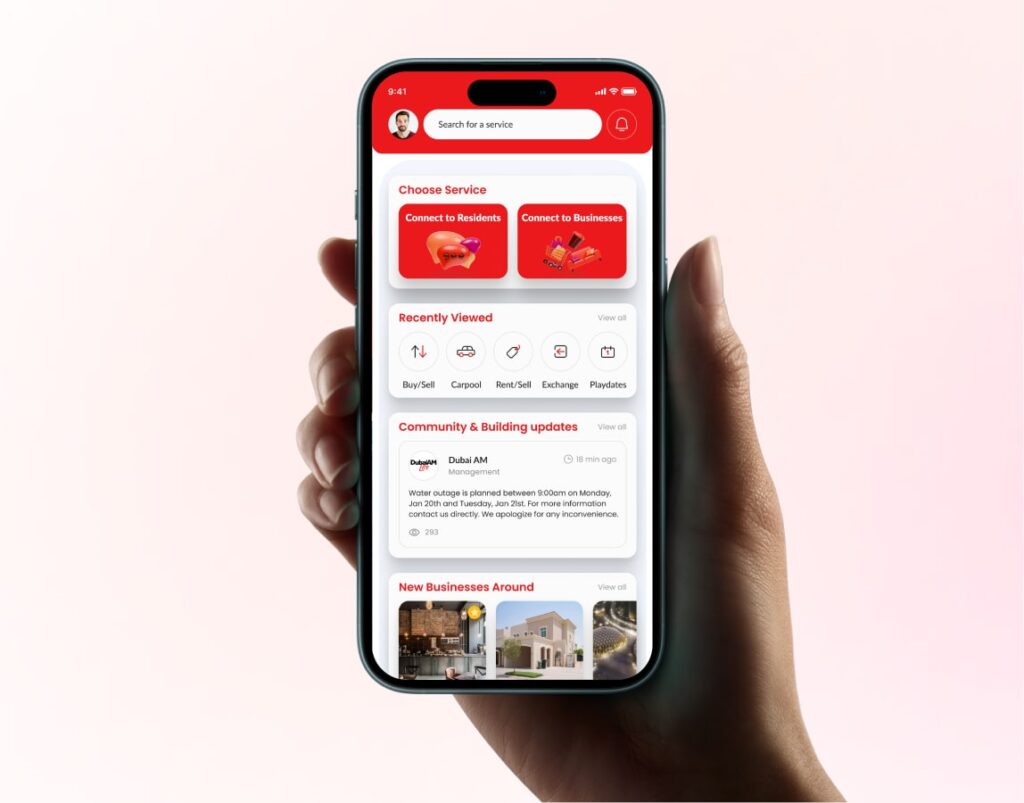

Negotiation Tactics: Research is power. Use live data from platforms like Dorz to find the current average rent for comparable properties in your exact building. If your landlord is asking for an increase outside of the RERA Rental Index guidelines, or if your building has many empty units, use this data to negotiate a lower increase or favorable terms (e.g., more cheques).

-

Total Cost Budgeting: When comparing rents, always factor in the associated costs: the high upfront deposit (usually 5%), agent fees, and the cost of utilities (DEWA). Your Dubai expatriate guide budget must account for these non-rental costs.

-

Know Your Rights: Dubai’s rental market is governed by the Rental Law (Law No. 26 of 2007). Familiarize yourself with the RERA Rental Index to understand the legal limits of any increase your landlord may propose.

VI. The Dorz Advantage & Call to Action

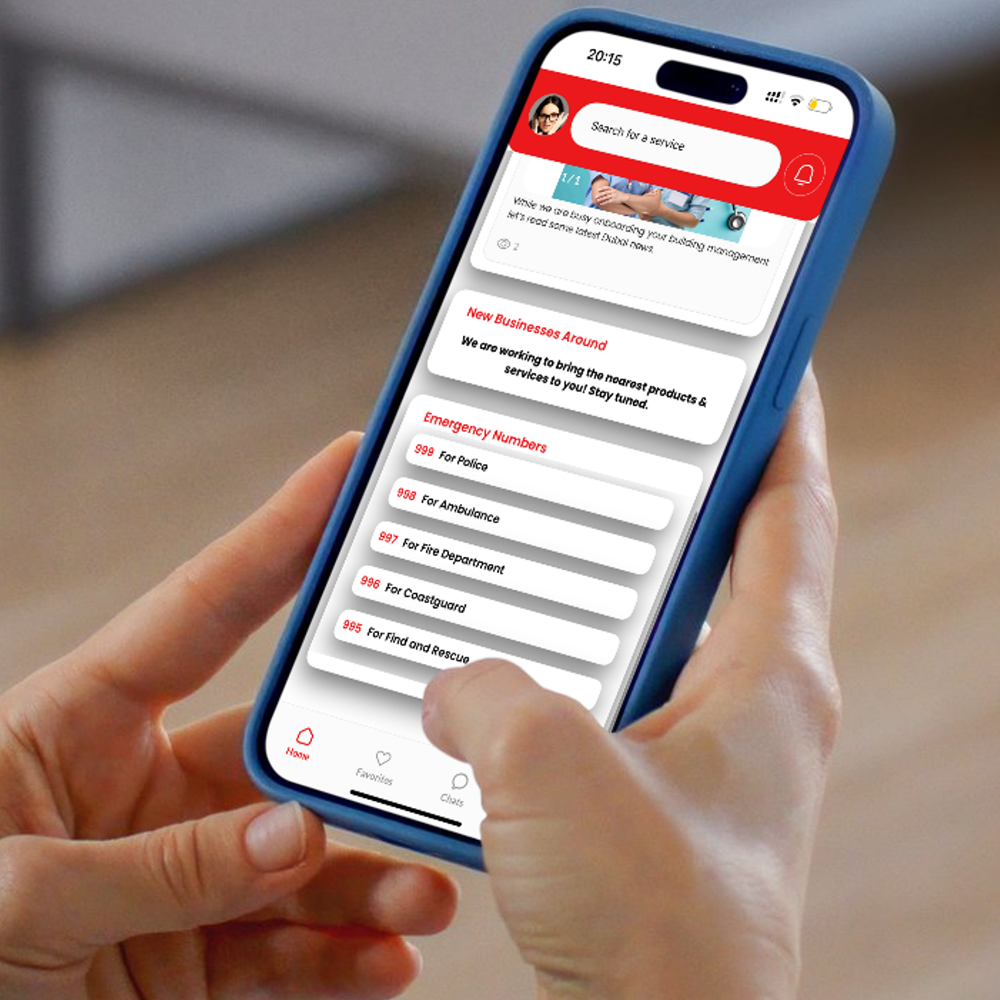

In a maturing market defined by micro-trends and localized supply spikes, success depends on access to transparent, real-time data. Dorz is built to give renters that edge.

We believe finding your perfect home shouldn’t involve paying high brokerage fees for simple searches. That’s why we facilitate free property listing Dubai—connecting verified tenants and landlords directly.

Ready to secure your lease before the Q1 2026 market hardens?

🔑 Check Live Listings on Dorz.online to benchmark prices and find your next home today: https://dorz.online/

For landlords, brokers, and business partners seeking smarter listing solutions: A Resource for Landlords and Businesses

VII. Conclusion

The Dubai rental market Q1 2026 presents a window of opportunity for the prepared tenant. The rapid increases are slowing, supply is increasing, and choice is returning to several key segments. By acting early, leveraging market intelligence, and knowing the Dubai rent forecast for your chosen area, you can successfully navigate your lease renewal and enjoy the stability that Dubai offers its long-term residents.